benefit in kind malaysia 2018

Generally non-cash benefits eg. 112019 provides for the following exemptions.

Malaysian Bonus Tax Calculations Mypf My

Economic activity picks up when you put more inputs to work particularly more labor.

. Free transportation between pick-up pointshome and work. These benefits are normally part of your taxable income except for tax exempt benefits which will not be part of your taxable income. BENEFITS-IN-KIND FOURTH ADDENDUM TO PUBLIC RULING NO.

112019 Translation from the original Bahasa. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND PUBLIC RULING NO. First James is required to file in income tax for company car benefit under Section 13 1 b of the Income Tax Act ITA 1967.

Benefit In Kind Sponsors. Discover the critical impacts of being kind to our community. 22004 Date of Issue.

Particulars of Benefits in Kind 4 7. Benefits in Kind 2 5. The economy always benefits when production increases.

The benefit in kind is still calculated based on the original list price. Food Beverages-In-Kind Sponsors. What is Benefit In Kind BIK.

It is viewed as employment income to James because it is a company car benefit provided by P-Tech his company for his continuous employment. Malaysia adopts a self-assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer. All benefits in kind received by an employee are.

Shop smarter with ShopBack Malaysias 1 Cashback Site and your definitive guide to Online Shopping - feat. In Malaysia not more than three times a year. RM 10000 x 12 x ⅓ RM 40000.

Annual Defined Value of Living Accommodation. In his case the company car benefit James needs to file in. BIK are non-monetary benefits.

Lazada Groupon Taobao ZALORA and 500 more. September 12 2021 Post a Comment This 2019 edition of the industry high level group ihlgs aviation benefits report coincides with the 75th anniversary of. 112019 Date of Publication.

Leong The Sales Manager aka the servant explained that his employer provides him with a Honda Accord where he can do his marketing everyday however he needs to pay tax for the benefit of using of the company car which included the benefit in kind BIK in his EA form. BIK benefit in kind are benefits provided by the employer to the employee in forms of services vehicles and lodging. Annual Defined Value.

INLAND REVENUE BOARD MALAYSIA BENEFITS-IN-KIND Fourth Addendum to Public Ruling No. Tax Exemption on Benefits in Kind Received by an Employee 14 9. Example 5 eden sdn bhd purchased a four wheel drive vehicle on 2203.

Paragraph 9 in LHDN 2013 for instance dental. Food and drink provided for free. Home Benefit In Kind Motor Vehicles Malaysia 2018 Table.

The benefit is provided to him throughout the year 2018. Kind Malaysia Virtual 2021 I 7-9 September 2021 Connecting Corporates with Civil Society - Time To Be Kind. The tax department has announced in october 2018 its intention to.

Benefits-In-Kind BIK in Malaysia. Other Benefits 14 8. And one should also be aware of exemptions granted in certain.

All income of persons other than a company limited liability partnership co-operative or trust body are assessed on a calendar year basis. Including benefits in kind value of living accommodation benefit provided and gross remuneration in arrears in respect of preceding years Name RETURN ON REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND PARTICULARS OF TAX DEDUCTION UNDER THE INCOME TAX RULES DEDUCTION FROM REMUNERATION 1994 FOR THE YEAR ENDED 31. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No.

Accommodation or motorcars provided by employers to their employees are treated as income of the employees. The report provides in-depth industry analysis information and insights of the. 12 December 2019 Page 4 of 27 524 The value of BIK based on the formula method provided to the employee by the employer can be abated if the BIK is.

All Benefits-in-Kind are technically taxable but Paragraph 8 of the LHDNs Public Ruling No. Benefit in kind on company car is calculated based on the prescribed value provided by the. Kind malaysia ubm malaysia connection corporates partnership humanitarian share inspire encourage recognise expertise non-profit kindness csr corporate social.

30 of Gross Employment Income under Section 13 1 a RM 6000 x 12 months x 30 no apportionment of ⅓ for this. Child-care centres provided by employers. This means that these benefits cannot be converted to cash when they are given to the employee.

19 April 2010 DIRECTOR GENERALS PUBLIC RULING A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is. Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary. Employees Responsibilities 23 11 Monthly Tax Deduction 23 12.

Background The Malaysian economy has shown resilience in recent years despite external shocks and has continued to perform. The motor vehicles tax called road tax is calculated on the basis of various factors including engine capacity seating capacity unladen weight and cost price. Benefit In Kind Motor Vehicles Malaysia 2018.

The Employees Provident Fund and the Social Insurance. Benefits-in-kind are benefits provided by or on behalf of your employer that cannot be converted into money. Deduction Claim 24 13.

And an important and direct way to raise labor input is by encouraging. Taxable by LHDN except for benefits listed in. March 7 2018 IMF Executive Board Concludes 2018 Article IV Consultation with Malaysia On February 9 2018 the Executive Board of the International Monetary Fund IMF concluded the Article IV consultation1 with Malaysia.

These benefits are called benefits in kind BIK. Malaysias economy continues to perform strongly with higher than anticipated growth at 58 percent in 2017. There are several tax rules governing how these benefits are valued and reported for tax purposes.

Ascertainment of the Value of Benefits in Kind 3 6. Employers Responsibilities 22 10. View PR_11_2019 - BENEFITS IN KINDpdf from TAX 2033 at Tunku Abdul Rahman University.

June 2018 is the FY ending 30 June 2018. Overseas not more than once a year with tax. These non-monetary benefits are considered as income to the employees.

Benefit In Kind Malaysia 2019 The Economy Magazine August 4 August 10 2019 Employees in all industries want to feel cared for and comprehensive benefits communicate that support. Employment Income Mercers 2018 total remuneration survey 50 50 81 18 51 car benefit eligibility by employee level September 13 2021 Post a Comment Only 85 of the value of the car leasing costs qualify for tax relief. March 7 2018.

The current rates of contribution varies from MYR010 to MYR1975 for the employee and MYR040 to MYR6905 for the employer. Food drink provided free of charge. Employers who hire foreign employees working in Malaysia excluding domestic servants shall register their employees with SOCSO and contribute to the Employment Injury Scheme.

Pdf Financial Sustainability Of Malaysian Public Universities Officers Perceptions

What Is Form Ea Part 1 Defining The Benefits In Kind

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

What Is Form Ea Part 1 Defining The Benefits In Kind

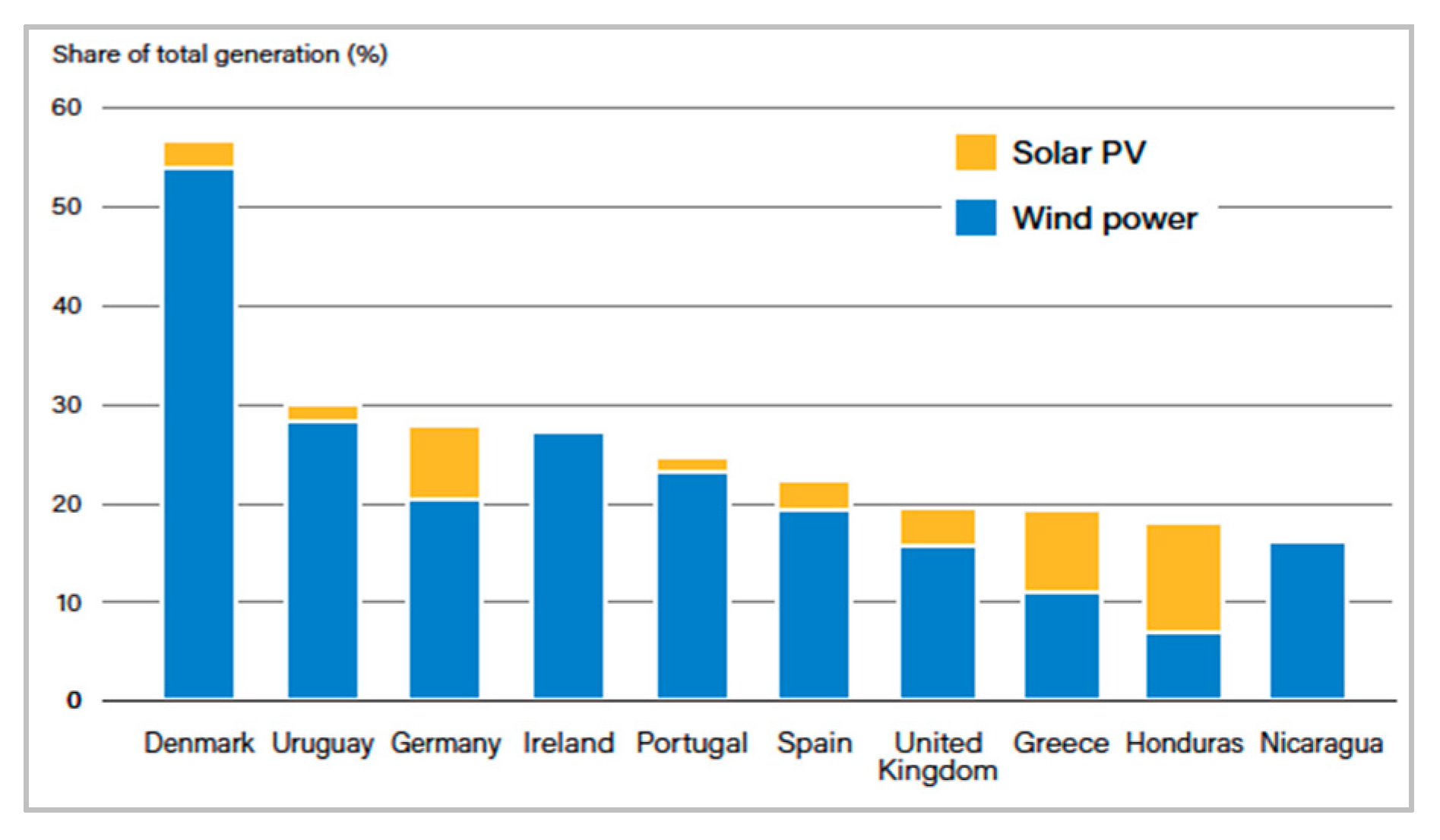

Energies Free Full Text The Potential And Status Of Renewable Energy Development In Malaysia Html

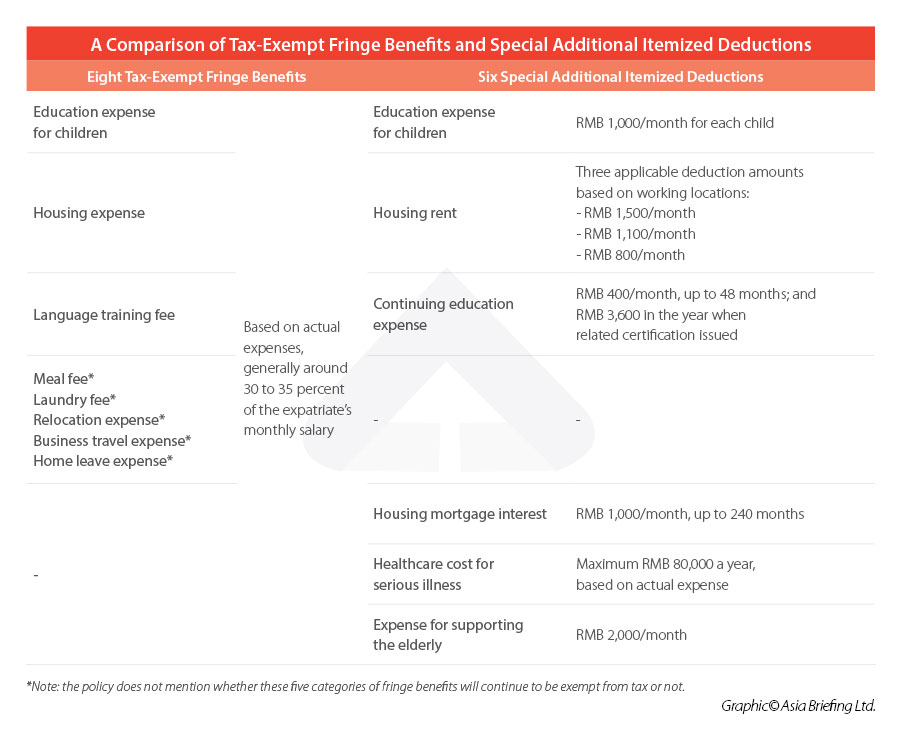

China Individual Income Tax Benefits For Foreigners Extended To 2023

What Is Bik In Malaysia How To Calculate Bik What Is Benefit In Kind

Income Tax Malaysia 2018 Mypf My

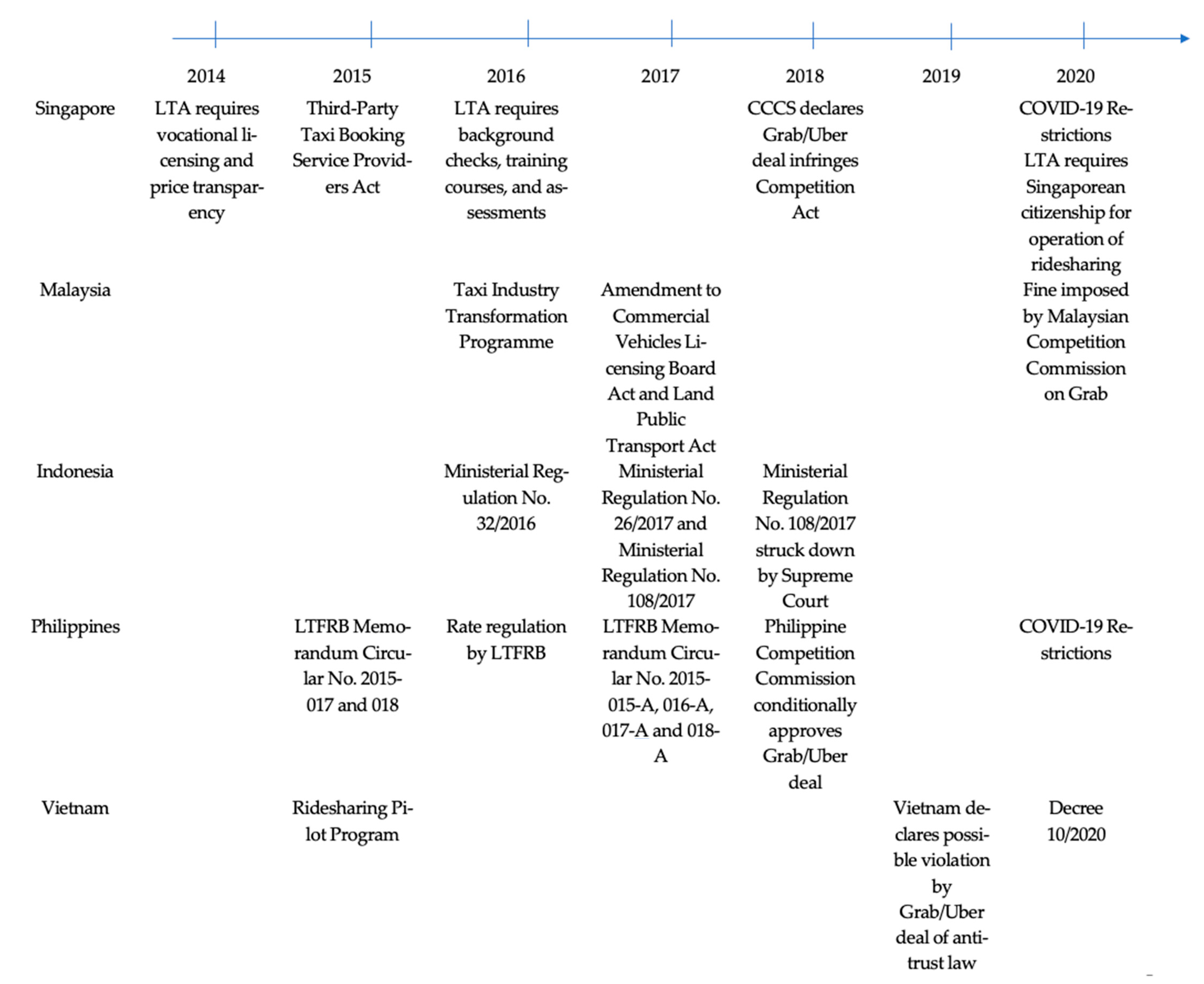

Sustainability Free Full Text Governance Of The Risks Of Ridesharing In Southeast Asia An In Depth Analysis Html

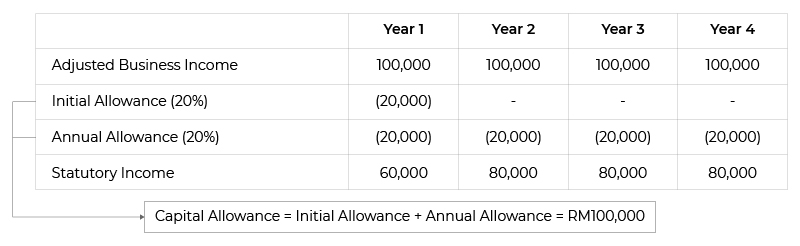

Capital Allowance Calculation Malaysia With Examples Sql Account

What Is Form Ea Part 1 Defining The Benefits In Kind

Company Car Benefit Should I Declare It On My Income Tax Filing

Why It Matters In Paying Taxes Doing Business World Bank Group

No comments for "benefit in kind malaysia 2018"

Post a Comment